Raidiam

User research and design for trust framework and data eco-system scale-up Raidiam.

Background

Having developed the Open Banking Trust Framework in the UK, the team behind Raidiam went on to develop a suite of data eco-system tools that have now been adopted worldwide by organisations working with regulatory frameworks.

Having begun life as a command line tool, Raidiam had been developed into a browser based service, but the complexity of the underlying system was now reflected in the UI.

Users were getting lost in looping journeys that branched back on themselves, and finding they’d forgotten to copy down key data from one section to the next.

Working alongside the lead product manager I set out to talk to users and understand some of the difficulties they were facing. Based on what we discovered, I then set about redesigning key journeys, rationalising the UI, and developing a basic design system and pattern library. At the same time I coached the team in ongoing, repeatable discovery practices that would enhance their ongoing product development work.

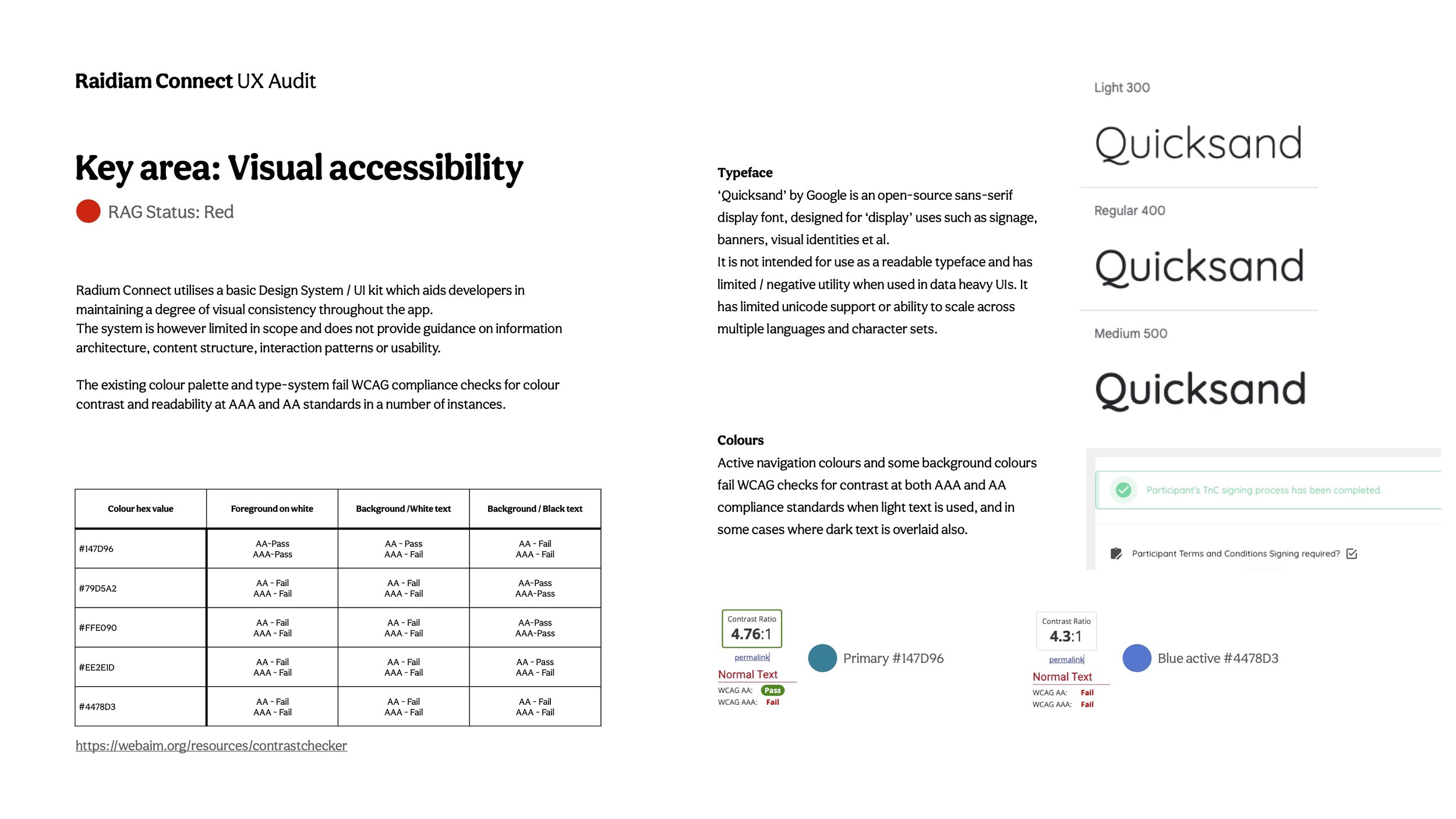

UX audit and generative user research

To gain an initial understanding of the issues users were facing when using the system, I performed an full UX audit / heuristic analysis of the platform, followed by a series of semi-structured user interviews to understand pains in depth, along with task analysis of user journeys and interaction flows.

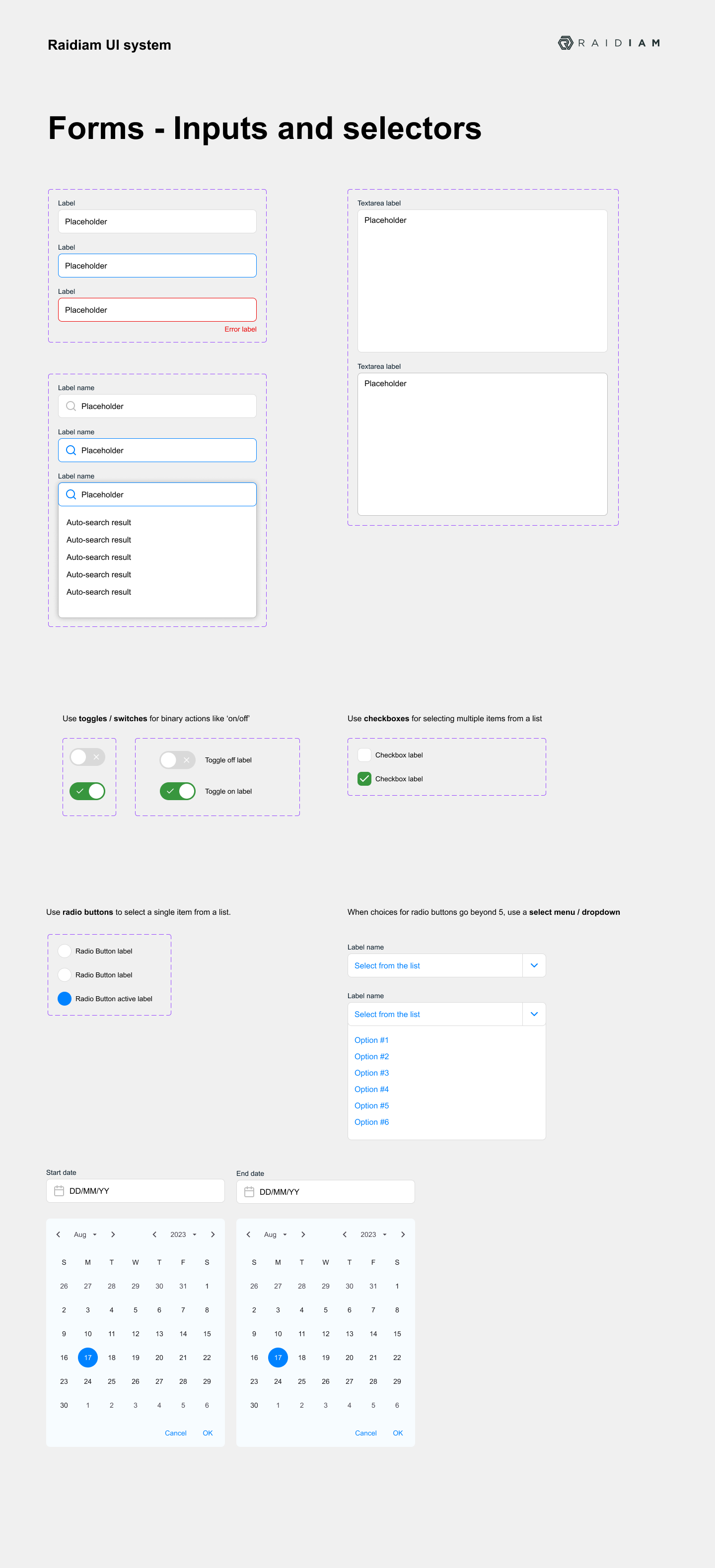

Design system

Initial user feedback highlighted a lack of consistency in the UI as being a major setback for enterprise users. Paring this back and developing a simple, consistent set of standards proved to be beneficial to both users and the team in terms of ongoing development.

The goal was to effectively set a baseline for the UI for further design and development work and create a white label version that could then be built on, branded and styled by Raidiam’s enterprise customers.

User journeys and UI

There was a degree of necessary complexity built into Raidiam, but user journeys had ended up mirroring this complexity too closely.

Features lacked a consistent and differentiated naming convention, meaning users frequently got lost in different sections of the application, and a number of key features were nested deep in parent sections forcing users to ‘go hunting’ for them, only to discover it was a ‘gotcha’ upon finding they were in the wrong place after all.

I focussed on taxonomy and the structure of top-level information to aid wayfinding and simplify these red routes for users, before simplifying interaction patterns and navigation.